Analysing my progress and profitability in cryptocurrency mining

TL;DR I purchased some cryptocurrency mining power in the cloud. I found that SHA256 mining is not that great, but Ethereum mining is more profitable. I plan on investing in more mining power.

If you want to jump in right now here are my affiliate links: https://www.genesis-mining.com/ Affiliate code for discount ODVnHM

Outsourcing Cryptocurrency mining

Previously I blogged how to mine Bitcoin on Azure (and why it is a terrible idea). In it I concluded that CPU mining is terrible with the advent of cheap USB ASIC miners and that you are better off purchasing one of them rather than wasting cloud computing credits.

I did more research and discovered rather than purchasing hardware, and running them myself and paying for electricity, maintenance, etc. I could just purchase raw mining power in a specialised mining datacentre.

Where did I purchase from

I eventually decided to go with https://www.genesis-mining.com

I liked that sign up was simple, that you could allocate your mining power/payouts (see below) and most importantly that it had Ethereum miners (look out for future posts on Ethereum!).

What did I purchase

I decided up front to invest a bit over $100 in SHA256 & Ethereum mining and roughly distribute it between the 2:

SHA256 USD $70.81 0.15 TH/s $0.45 per GH/s Lifetime contract

Ethereum USD $57.62 3 MH/s $17.99 per MH/s 1 year contract

Distributing the mining power

The reason I liked Genesis Mining was how you could allocate your mining and payouts across the many altcoins. Below I’ve included screenshots of the payout screens and my configuration.

SHA256

The original Bitcoin hashing algorithm. Mining power is being added to this at a crazy rapid pace with ASIC manufacturers trying to cash in and mine as many Bitcoin as they can. Profitability of mining this will drop rapidly.

Here I allocated my payouts as 90% Bitcoin (as that was the point of the exercise) but then 10% into Dogecoin. Dogecoin was created as a “fun” cryptocurrency and the development community has fun with using it as tips throughout Reddit. I wanted a small trickle of this so that I could tip people.

X11

Built to be more ASIC resistant by incorporating 11 different hashing algorithms.

I haven’t purchased any mining power in this mining algorithm yet, but I plan to in the future.

Ethereum

Not much in the way of options, as it has been designed to be a unique ASIC resistant algorithm. This is just for Ethereum mining.

Analysising the data

I’ve been mining for 9 days now and thought it would be a good time to analyse how my mining has been going.

Payouts occur at the same time every day, meaning my 1st day only saw a partial payout on the day I signed up. I have removed the datapoint to make the graphs clearer.

Exchange values used are from https://www.coingecko.com

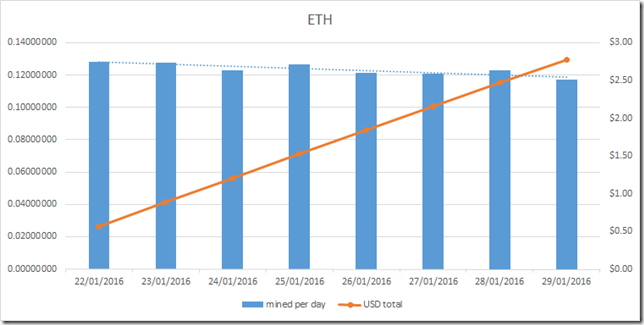

Ethereum

The amount I’m mining each day has been trending very slightly downwards but is more or less stable.

Profitability/day: $2.77 / 9 days = $0.30/day

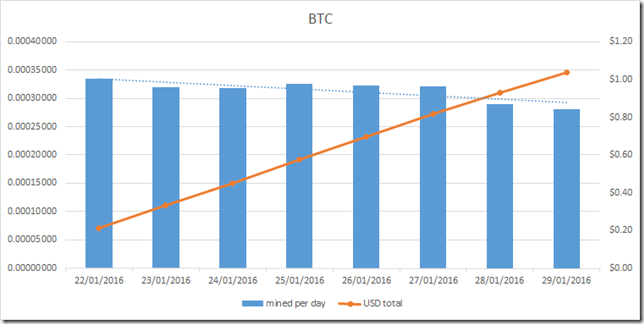

SHA256 Bitcoin

Fairly stable mining, but it is trending down sharper than Ethereum. This is most likely due to the rapid pace that additional mining capacity is brought on globally from all the ASIC miners

Profitability/day: $1.04 / 9 days = $0.11/day

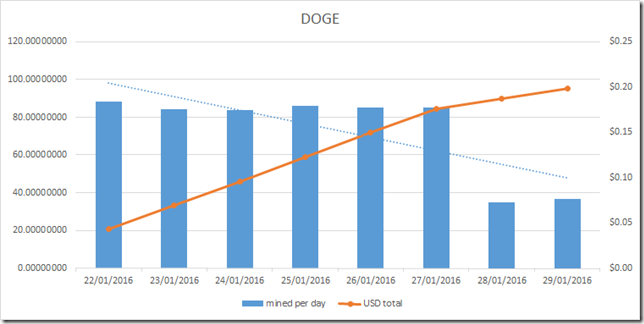

SHA256 Dogecoin

A very sudden drop in Doge earned per day. This can be explained by looking at the exchange (see graphs below).

Dogecoin isn’t mined directly by Genesis mining, but instead Bitcoin is mined and then converted into Dogecoin. Over the last 3 days the price of BTC has gone down while DOGE has gone up, meaning during the daily conversion of earned BTC to DOGE the exchange rate is lower.

Profitability/day: $0.20 / 9 days = $0.02/day

Exchange rates for last 30 days

Profitability breakdown

Ethereum mining

1 year contact: $57.62

Daily profit: $0.30

Daily ROI: 0.30/57.62 = 0.0052

Yearly profit at current values^: $0.30 * 365 = $109.5

SHA256 mining

Lifetime contract: $70.81

Daily profit: $0.13 ($0.11 + $0.02)

Daily ROI: 70.81/0.13 = 0.0018

Yearly profit at current values^: $0.13 * 365 = $47.45

^I do not believe that this will be the true yearly values. Exchange rates will fluctuate and amount mined per day will go down.

I was interested in the SHA256 miners because of the lifetime contract that will always be mining until it is no longer profitable. However I am wary of the long term profitability of it. The chart below from blockchain.info shows the crazy rate that ASIC miners are are bringing on more hashing power. This will rapidly diminish the amount of BTC I mine per day. I do not plan to invest more in Bitcoin mining as I don’t think it will economical to compete.

Conclusion

I am very happy with the progress of my Ethereum miners. Ethereum is more resistant to ASIC miners and therefore the amount of global mining power brought should not reduce my profitability as much as quickly as it is with SHA256.

Ethereum mining is also almost 3x as profitable per $ as SHA256 mining (0.0052 vs 0.0018).

Because of this I plan on purchasing more Ethereum mining power as well as some X11 mining power. But I will not be investing any further in SHA256 mining.

I’d like to get some data points from the X11 miner to share next time.

Remember if you want to signup for your own, here are my affiliate links to get a discount

https://www.genesis-mining.com/ Referral code:ODVnHM